7 Best Budgeting Apps for Couples to Sync Spending & Savings

Discover the 7 best budgeting apps for couples that simplify tracking expenses, syncing accounts, and hitting shared savings goals—start budgeting together today.Table of Contents

Why Budgeting Matters in Relationships

Money talks can make or break our peace at home. Research shows that 40% of couples feel anxious discussing finances. The right budgeting apps for couples relieve that pressure by giving us one clear dashboard to track cash-flow, avoid “mystery” charges, and celebrate every milestone—whether we’re saving for a baby, a backpacking trip, or just a chill Friday-night takeout.

How We Picked These Apps

We looked at more than 30 shared finance apps, comparing security, bank-sync breadth, real-time notifications, and partner-friendly collaboration features using reviews from Forbes, CNBC, NerdWallet, and firsthand user stories on Reddit. The seven below rise to the top for day-to-day money management for couples.

Quick-Glance Comparison

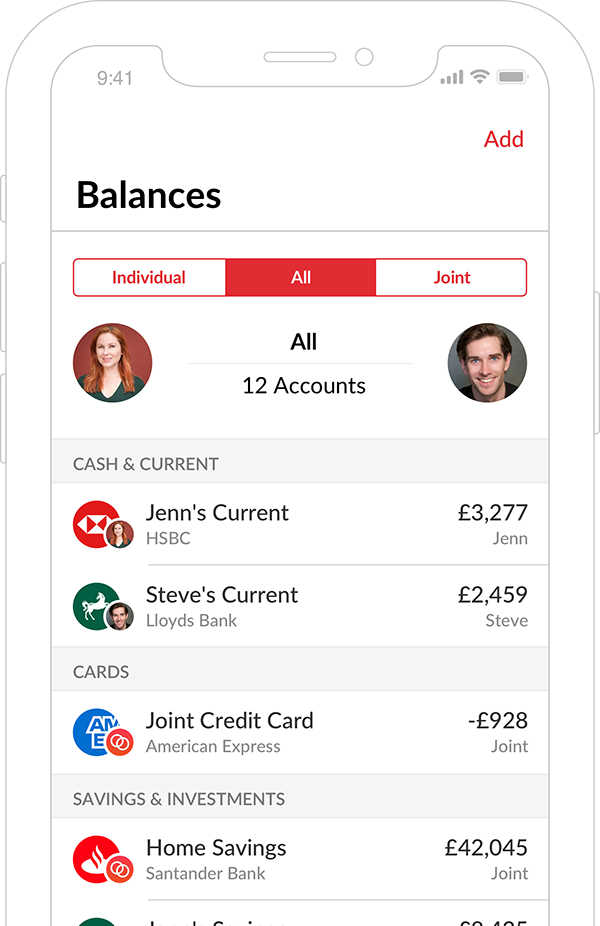

1. Honeydue

Key Features

- Links bank, credit, loan, and investment accounts—showing only what each partner agrees to share.

- In-app chat for “What was that $42 Starbucks run?” messages—no awkward texts.

- Bill calendar pings us both before due dates, so late fees vanish.

Pros

- Completely free; great starter option.

- Emoji reactions turn budget check-ins into quick high-fives.

- Optional joint checking with debit cards FDIC-insured by Sutton Bank.

Cons

- Mobile-only view—no desktop dashboard yet.

- Advanced reporting tools are limited compared to paid rivals.

Real-World Scenario

Think freshly engaged partners juggling rent, streaming subs, and wedding deposits. We set a $600 dining-out limit; Honeydue buzzes both phones when we hit $540—perfect cue for a cozy cook-in night.

Focus keyword count: budgeting apps for couples (1)

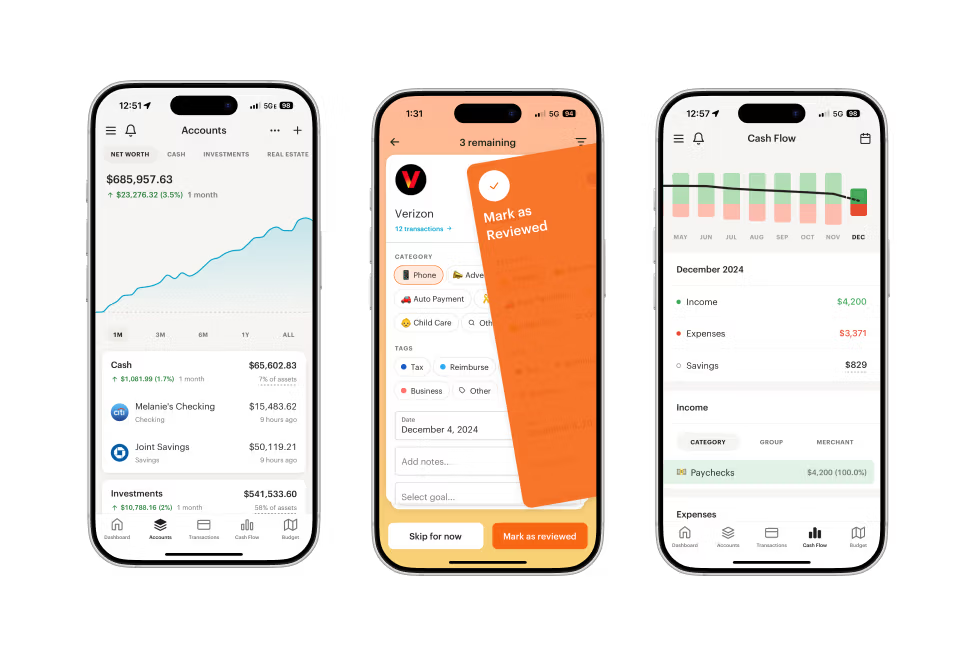

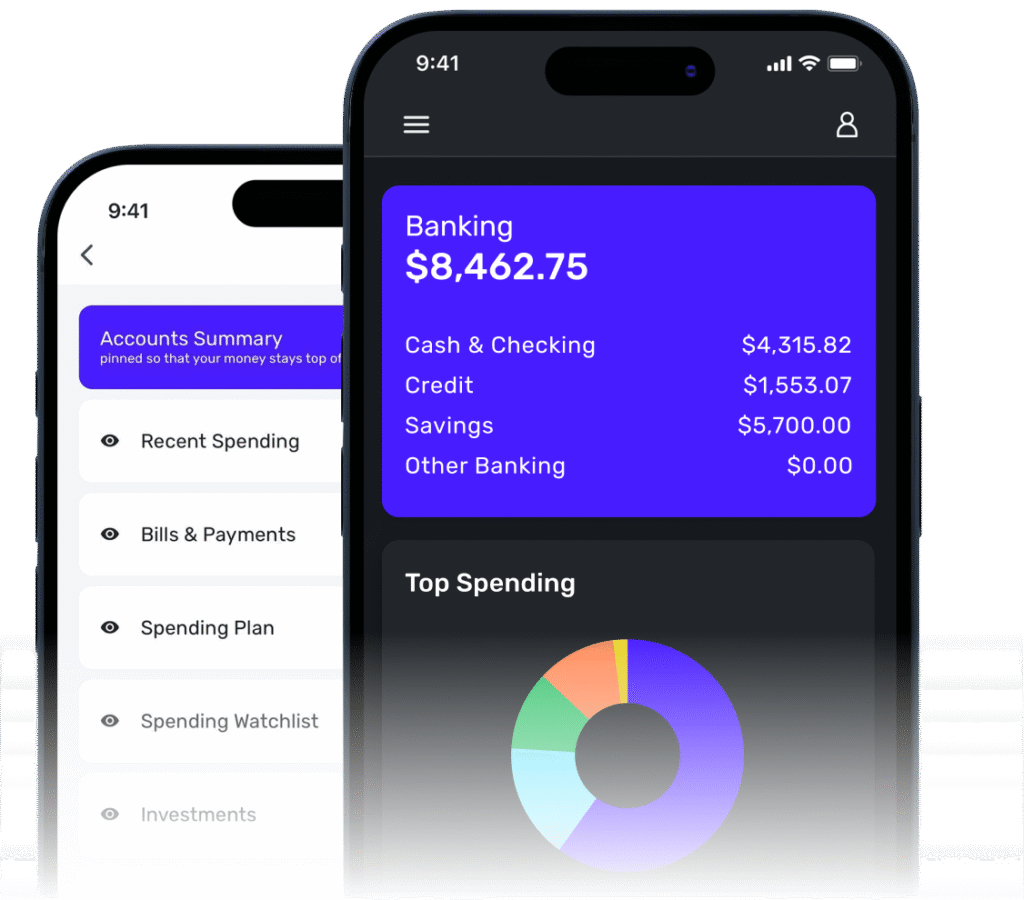

2. Monarch Money

Key Features

- One shared space for net-worth snapshots, cash-flow forecasts, and retirement projections.

- Separate logins keep passwords private while revealing the full money picture.

- Powerful rules auto-categorize transactions—save hours of manual cleanup.

Pros

- Customizable categories and roll-up reports satisfy data nerds.

- Goal-tracking slider shows progress toward a down-payment in real time.

- Slick UI makes budget “date nights” oddly fun.

Cons

- Annual fee after the trial ($99.99) may deter frugal pairs.

- Investment analytics are basic; serious traders might crave more.

Best For

Couples merging finances post-honeymoon who want a “mission control” dashboard without spreadsheets.

Focus keyword count: budgeting apps for couples (2)

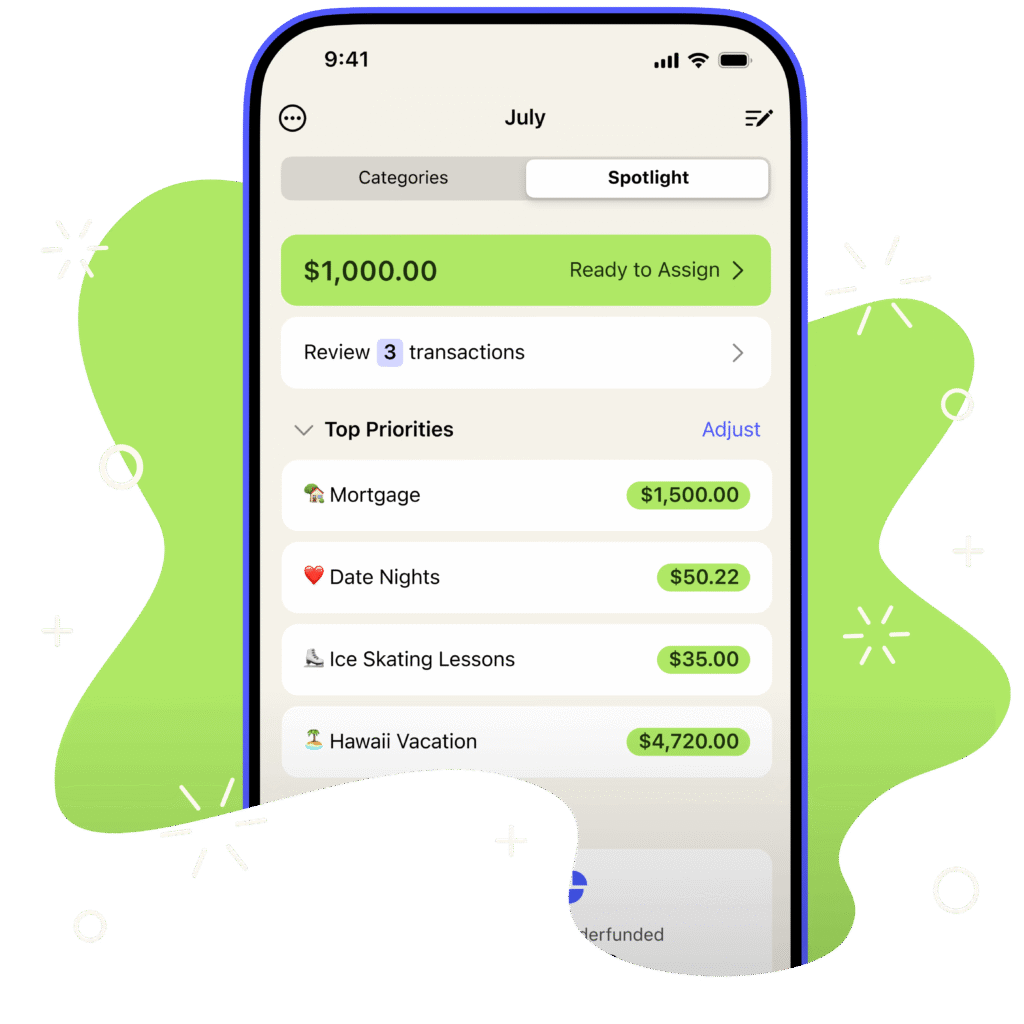

3. YNAB (You Need A Budget)

Key Features

- Zero-based method assigns every dollar a job—our money finally has purpose.

- Shared budget accessible via family plan at no extra cost.

- Workshops and live classes help us build a money language together.

Pros

- Culture of proactive planning: we fund bills a month ahead.

- Detailed reports highlight overspending trends fast.

- Strong privacy controls for partners who keep separate accounts.

Cons

- Steeper learning curve; envelope newbies may feel overwhelmed.

- Must import some transactions manually or through third-party bank feeds.

Relationship Scenario

Long-distance partners syncing once a week on Zoom can walk through categories together, agree on vacation savings, and celebrate progress toward seeing each other more often.

Focus keyword count: budgeting apps for couples (3)

4. Zeta Money Manager

Key Features

- Lets us decide what to share—personal, joint, or both.

- Automated transaction tagging, push notifications, and net-worth trackers.

- In-app notes for gentle “Let’s chat about that gadget splurge” nudges.

Pros

- 100% free core app; banking-grade AES-256 encryption.

- Ideal for partners maintaining individual bank accounts yet paying shared bills.

- Daily email digests keep us accountable without extra logins.

Cons

- Smaller bank-sync list than older competitors (workarounds exist).

- Occasional sync hiccups reported by Android users.

Best For

Busy parents who split daycare and grocery costs but keep side-hustle money separate.

Focus keyword count: budgeting apps for couples (4)

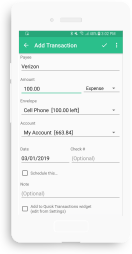

5. Goodbudget

Key Features

- Digital envelope system—assign every paycheck to “Groceries,” “Rent,” or “Date Night” envelopes.

- Syncs up to five devices on the paid plan; handy if we use phones and tablets.

- Manual entry encourages mindful spending; we touch every transaction.

Pros

- Free tier handles 20 envelopes—enough for starter budgets.

- Community podcasts offer empathy and tips for love + money talk.

- Low tech means lower security risks; nothing sensitive stored in servers.

Cons

- No auto-sync; manual inputs can feel tedious for high-volume spenders.

- Reporting is basic unless we export CSVs.

Relationship Scenario

We’re newly cohabiting and want to try envelope budgeting without fees. Goodbudget’s “Groceries” envelope empties by the 20th, so we swap restaurant plans for a pantry-challenge cookoff.

Focus keyword count: budgeting apps for couples (5)

6. Quicken Simplifi

Key Features

- Visual spending plan adapts to 50/30/20, zero-based, or hybrid budgets.

- Separate logins show all connected accounts without password sharing.

- Spending-forecast charts predict if next month’s cash will dip below target.

Pros

- Flexible rule-based categorization learns our habits quickly.

- Robust web interface plus smooth mobile app.

- Unlimited bank connections, including investing brokerages.

Cons

- Subscription required after trial (about $72 / yr).

- Some couples find the data-dense dashboard intimidating.

Best For

Analytical duos who enjoy colorful graphs and future cash-flow simulations for “what-if” scenarios.

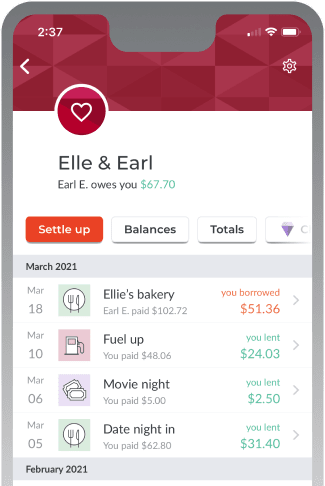

7. Splitwise

Key Features

- Core mission: split expenses with partner or groups effortlessly.

- Handles unequal percentages—perfect for income-based splits.

- One tap settles up via PayPal or Venmo; no awkward “you owe me” texts.

Pros

- Always-free basic plan; Pro adds receipt scans for $3 / mo.

- Tracks IOUs over months—Ideal for couples sharing rent but keeping all else separate.

- Works offline; syncs when back online—handy on road trips.

Cons

- Not a full budget planner for couples; no category targets.

- No account-sync, so we rely on honesty and app inputs.

Relationship Scenario

Roommates-turned-lovebirds use Splitwise to divide utilities 60/40 (higher earner pays more) while saving receipts for condo down-payment proof.

Putting It All Together: Choosing the Right App

How Couples Can Save Money Together

- Schedule a monthly “money date” with snacks—review your couples budgeting tools together.

- Turn on real-time notifications; celebrate small wins like under-budget grocery weeks.

- Automate transfers into a shared high-yield savings account the moment paychecks land.

- Use app spending insights to set playful challenges: “No-takeout February” or “$10-date night week.”

Each of these moves becomes easier when our chosen shared finance apps give instant feedback.

Also Check Out est Smart Ring vs. Smartwatches in 2025: What We Loved, What Disappointed,

Frequently Asked Questions

What is the best budget app for couples?

The “best” depends on our style: Honeydue is great for free mobile-only tracking, while Monarch Money shines for all-in-one planning with robust goals.

How can couples manage finances together?

Pick one of the budgeting apps for couples, connect both partners’ accounts (or only shared ones), set common goals, and hold a 15-minute weekly check-in—consistency beats complexity.

Is there a free budgeting app for partners?

Yes—Honeydue, Zeta, and Splitwise all offer free core plans, making them best budgeting apps for couples on tight starter budgets.

[…] Also Check Out Best & Worst Budgeting Apps for Couples […]